This Might Be My Best Idea for 2022

This is turning into a funny year. Stocks are going down. Interest rates are set to go up. And I’m focused on gold.

A Quick Guide to Opening Your First Investment Account

If you’re like most people, your first step into in the world of investing is your 401(k). You get a job, fill out a bunch of forms, and somewhere in that paperwork, there’s information about an employer-sponsored retirement plan.

You want to participate as soon as you’re eligible. And you want to contribute the maximum amount allowed. For the 2022 tax year, people under age 50 can contribute up $20,500 to their 401(k). Folks 50 and older can drop in an additional $6,500.

These accounts are tax-deferred. And in many instances, employers will match your contributions. So, neglecting to make those contributions is no different than turning down free money. Please, do not make that mistake.

If you’re unsure if your employer sponsors a 401(k) plan… pick up the phone, call your HR department, and ask. Do not run to Chipotle first. Do not wait for your phone to cool down. Do not wait until Mercury is in retrograde. This is far more important than all that.

Worst case scenario, they say “no.” And you move on to other tax-advantaged savings options, which we’ll get to in a moment.

Best case scenario, Linda in HR says, “Yes, we have a plan, you’re eligible, and we offer generous matching. I’ll send you the forms. Then we can discuss your questions.”

There’s a good chance something like that will happen. As of March 2020, 67% of private sector workers were eligible for employer-sponsored retirement plans. So, you don’t have to reinvent the wheel here—please, just let the Lindas of this world help you.

-

What if your employer doesn’t offer a 401(k)?

Not to worry—you can still plunk money into a tax-advantaged retirement account. There are several flavors… IRA, Roth IRA, SEP IRA, etc. We’ll touch on the most common: the traditional IRA.

With a traditional IRA, you contribute pre-tax dollars—up to $6,000 for the 2022 tax year, or up to $7,000 if you’re 50 or older.

Note: This is not where you keep your emergency fund. In fact, don’t put money in an IRA if you think you will need it before age 59½. If you take money out of an IRA before then, you’ll have to pay income tax on the withdrawal, plus a 10% penalty.

As with most tax stuff, there are all kinds of exceptions and a lot of fine print. But long story short: consult your tax professional before taking an early withdrawal.

Otherwise, the biggest downside to an IRA is the annual contribution limit is fairly low. So, if you can, open an IRA and contribute the maximum allowed per year. Then open an individual investment account, where you invest even more.

-

Great, so how do you open a brokerage account?

First, you need to pick a brokerage. There are plenty of options: Vanguard, Fidelity, Schwab, and so on. You’ll want to do your own due diligence here. But keep in mind, this is not the place to tango with a trendy app. Go with one of the reputable, well-established players.

I’ll walk you through opening a Vanguard account, so you get a feel for what to expect. I don’t have any kind of monetary arrangement with Vanguard. It’s just an example of a popular platform that’s easy to navigate. The process will be similar at the other big outfits.

To start, just click on this link, which will take you to the “open an account” page on Vanguard’s website. It looks like this…

Click on “Let’s open my account.”

From there, it’ll ask for all the standard personal information, including your name, address, Social Security number, birthdate, citizenship, phone number, employment status, employer’s address, income, and net worth.

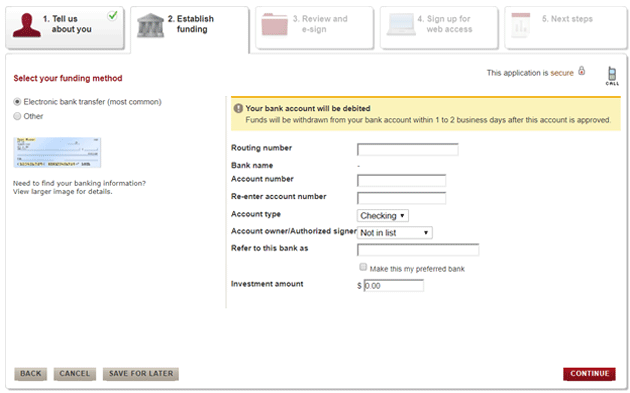

Next, you will need to provide bank information so you can transfer funds from your bank account to your new brokerage account. You will also need to choose how much you want to transfer, and the type of account.

The next step is to review all the information you typed in to make sure it’s accurate. If it is, verify and move on.

Finally, you need to sign up for "web access," which is just your online account. This will allow you to view your account balances and performance whenever you want. If you need any help along the way, you can call Vanguard at 800-992-8327.

Completing this online application takes about 5 to 10 minutes. After that, it will take Vanguard one to two days to review your application and respond via email.

I’ve talked to a lot of people who know they’re supposed to do this stuff. But the nitty gritty details seem to get in the way—the minor nuisance of opening a new account, navigating a new online platform, remembering a new password.

Then there’s the trouble of figuring out what to invest in. Longtime readers know the answer, though: 20% stocks, 20% bonds, 20% cash, 20% gold, 20% real estate. Go here for more details.

Jared Dillian

|

Diversification Is No Defense Against a Bear Market

Investors are all gorked up on crypto. But the problem with that isn’t crypto. The problem is poor portfolio construction.

Saving for Retirement Isn’t That Complicated

Saving for retirement can feel overwhelming. But all it takes is $17 a day and a little attention to where your money goes—no austerity required.

‹ First < 22 23 24 25 26 > Last ›